(Updated Jan2018)

Before you invest your CPF, consider the following 3 points

1. Do you have housing loan commitments?

If you are looking to buy a new house or upgrade in the coming few years, it it time to look closely at your budget. Invest only the excess amount.

If you are taking a HDB loan, do you know that your entire CPFOA will be drawn down as downpayment for the house? Nothing will be left. That means you cannot stop work because you need CPFOA inflows in future just for mortgage deduction.

One strategy is to invest a portion of your CPFOA so that you have “spare” amounts kept under the CPFIS. This can be for future mortgage repayments if you stop work.

2. How long are you comfortable to invest? : IE do you have “HOLDING POWER?

What is holding power? Holding power is basically no urgency to sell.

CPF money cannot be taken out. If age55 is still some years away for you, think long term and you should actually have strong holding power.

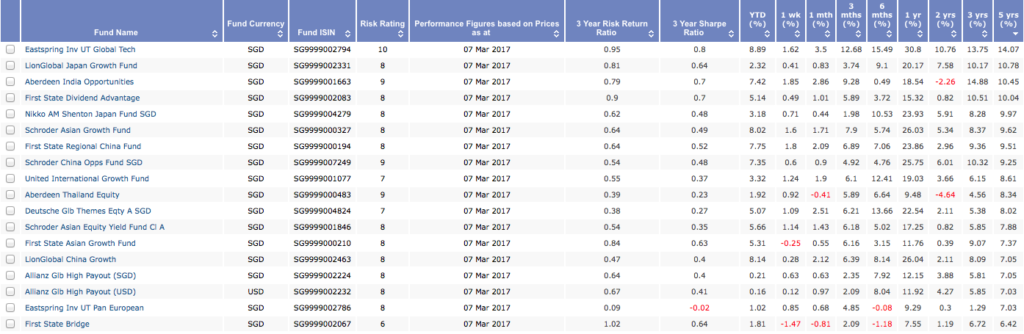

Equity prices go through market ups and downs unlike a guaranteed 2.5% interest rate by CPFOA. Hence, it requires enough time to get a good average return. From the fund list below, some did significantly better than 2.5% pa.

“It’s not timing the market, but time in the market”

These are some examples of investment tools with a superior 5y rate of return:

Unit Trust Funds

3. Is your investment strategy going to be worth the risk

Investing is NOT CHOOSING THE TOP PERFORMING IDEA LAST YEAR! Creating an investment plan is to maximise your chances of “buying low and selling high” for investment success.

A smart investor needs to be

- Disciplined. When markets come down – hold on. When markets go up – don’t be greedy.

- Diligent. Review the portfolio regularly for methods to improve

Why invest CPFOA?

Investing CPFOA to get more than 2.5%p.a is really not difficult at all!

It does not affect your cash-flow and as mentioned, you have a good chance to do well especally if you think long term.

$50k kept in CPFOA will grow to $64k (with CPFOA interest).

But a $50k invested for 10years at just a mere 5% return will get you $81.4k. Thats $17.4k more.

A 8% pa return will get you $108k from a $50k initial investment! And it is not impossible. Equities in technology sector has done >14%pa over the last 5years.

Invest only CPFOA and not CPFSA. 2 main reasons:

- CPFSA gives 4%pa return which is very decent. You should keep it as your “safe assets” and invest aggressively your CPFOA and cash savings.

- Funds that qualify for CPFIS-SA are even more limited and can’t perform significantly better than 4%pa. You cannot invest into ETFs or gold either.

PS: To invest your CPFOA you would need an “agent bank account” with UOB/DBS/OCBC and it can be done online.

Ready to invest? Click here to “Contact Josh Tan”.

Image credits: http://www.businesstimes.com.sg/government-economy/cpf-interest-rates-offer-best-riskreturn-tradeoff