Prime Minister Lee Hsien Loong (in his national day rally 2016) singled out disruption as the defining challenge among the economic issues Singapore is dealing with. In the space of disruption, it is a winner takes all game! Companies who get it wrong face a certain painful death as they get squeezed out of any growth. So how do you invest in the right “disruptive” companies?

Presenting the LionGlobal Disruptive Innovation Fund with bonus analysis!

In the “Age Of Disruption”, new methods bring high revenue growth but most big innovators are not based in Singapore. LionGlobal Disruptive Innovation Fund (LGDIF) was launched with the objective of pooling together (in an investment fund) the best 100 companies that are “disrupting” the traditional businesses.

If you are a local investor only, you may have missed out on the amazing growth of AMAZON.com or JD.com as shown below.

According to the team from LGDIF, there are currently no exact alternative funds or ETF with this theme. Hence, they do not have a benchmark constrain. Most of the comparison is done against MSCI world index.

Smart Beta – How it is works in LGDIF

The fund will be passively managed using smart beta and its top 100 holdings are rebalanced quarterly.

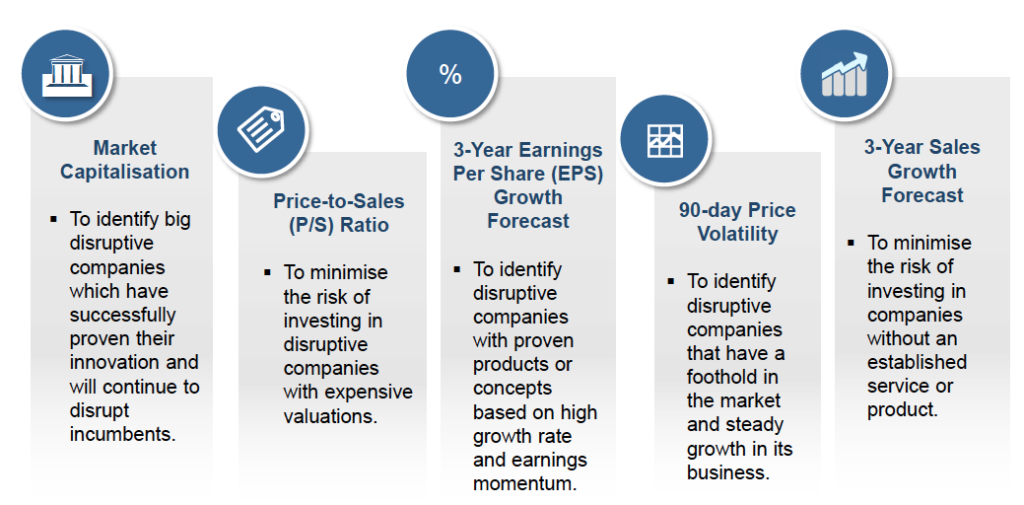

Smart Beta is not a new form of managing an investment portfolio but rather it is an emerging method to reduce charges According to Investopedia, “Smart” refers to the use of an alternative methodology rather than following an index’s size-based (market-cap) allocations. A smart beta investment strategy is designed to add value by strategically choosing, weighting and rebalancing the companies built into an index based upon objective factors. I’ll touch on LGDIF’s objective factors in a while.

Smart Beta approach uses screens based on fundamental analysis principles to determine which companies should be given a larger piece of your investment money. This is unlike blindly weighting companies solely according to their size like an index.

What is LGDIF methodology?

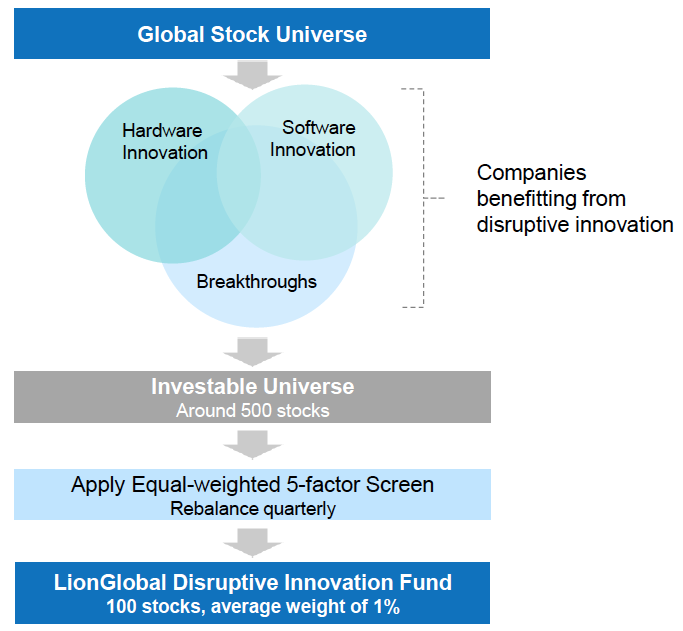

The team running the fund researches companies listed all over the world global for names that qualify as “Disruptors”. They break them down into 3 broad categories which are software innovation, hardware innovation or breakthrough technology. Some examples will be online shopping firms and social media (software innovation), self-driving cars and smart grid (hardware innovation), artificial intelligence and big data (breakthrough technology).

A list of 500 companies has been created and companies are ranked based on the 5 criteria below with equal rating.

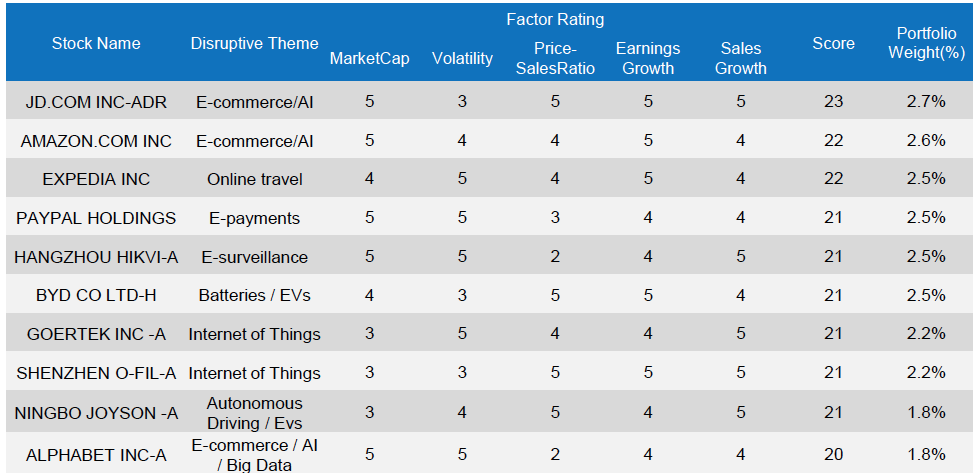

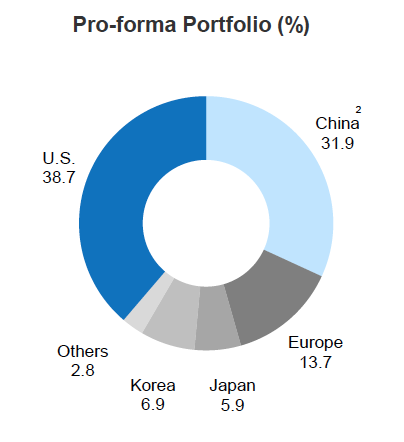

A dive into the current top allocations

Once the companies are scored, they are ranked and the highest scores get 2.5% portfolio weightage at least. From the list, there are definitely familiar names like Amazon.com or Expedia or Paypal which you may use. However, there is a massive 31.9% allocated towards “disruptors” based in China unlike a tradition technology fund. These companies are not easily accessed by most retail investors. Names such as JD.com (which I will elaborate further), Hangzhou HIKVI surface and BYD Co all covering different innovations.

Quick run on JD.com

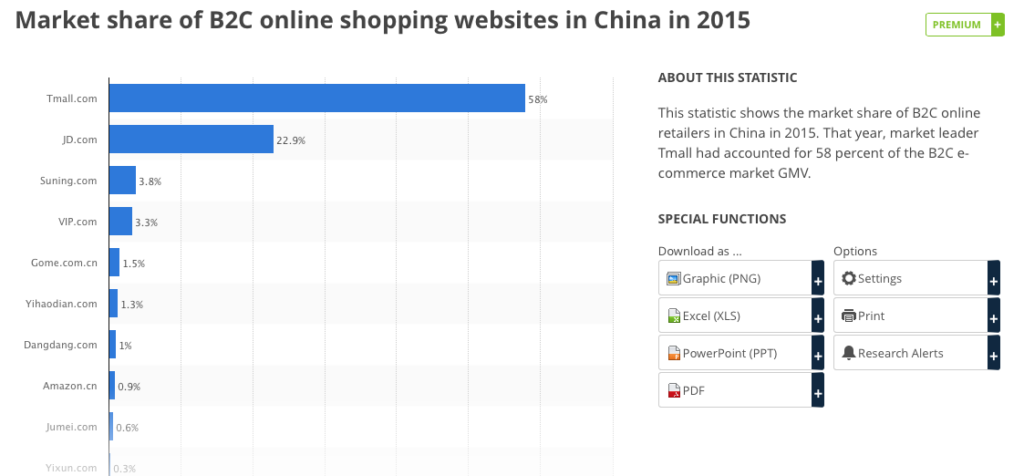

It is the top allocation to LGDIF currently. According to this source, it is a major competitor of Tmall run by Alibaba.com, having a 22.9% market share of B2C online shopping websites in 2015. Recently however, its share performance has lagged that of Alibaba.com. Hence, it commanded a good score with its relatively cheap price-sales ratio which placed it as the top company your investment money is going to.

Chinese E-commerce space is still fast growing, don’t miss out on this opportunity!

Structure of LGDIF

LDGIF is a retail level unit trust with 2 classes (class A & class I). The class I (institution) has a lower annual management charge (AMC) of only 0.68% in comparison to the Class A which is 1%. However, you may only subscribe to the Class A one currently.

Funds are Cash and SRS approved at current moment.

Last words

Many did not expect Alibaba.com to grow to its size today and it is still fast growing. This fund LDGIF is best used as a passive portfolio allocation with a long term view. This is to give its smart-beta methodology the best opportunity to perform. As it was launch in March2017 only, there are no ratios for the fund to measure against. Our recommendation is to invest gradually into this fund and see better if its methodology works out over time.