This is a common question I get especially in a preliminary appointment. With more than 1,000 listed retail funds (and many more that are non-listed), we want to be choosing correctly. There is a saying: “Invest where the growth will be and be patient”. Hence, my recommendation can even be one that has performed poorly last year.

These are 3 guidelines on which funds to look out to buy.

1) Objective of the fund

I look for the mandate of the fund. As of now, I have a preference for small cap companies (i.e. non blue chip companies). In this example, let’s use PineBridge Asia Ex Japan Sm Cap Eq A5CP SGD which is an Asian focused fund into smaller sized companies.

From fact sheet

“…. seeks long term capital appreciation by investing in smaller to medium-sized companies in the Asian Region i.e. companies whose assets, products or operations are in the Asian Region. In practice, at least 50% of the Sub-Fund’s investment will be in companies whose free float adjusted market capitalisation at the time of purchase is less than USD 1.5 billion….”

If I am comfortable with the mandate, I will screen this fund against a similar fund based on it’s track record. While nothing is guaranteed looking forward, we want a fund manager that has proven to unearth winners in the stock market consistently.

2) Price-earnings (PE) ratio of the market/sector

I will look for the current PE of the sector. However, do note that PE ratio does not tell the full picture of the valuation. It is best compared against historical levels as well as it expected earnings growth.

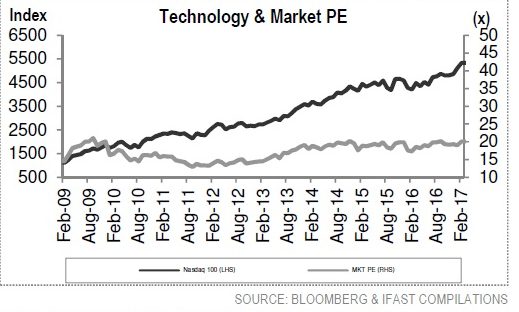

This chart below is the PE ratio of technology as a sector. As you can see, technology as a sector has risen quickly over the last 10 years, doing a >300% gain. The PE levels for technology sector have also trended up gradually to about 20x as earnings have risen in tandem with the share price. Hence, it may still possibly be a good investment.

If the sector’s prospects deteriorate or the price climbs way too high, it may become expensive and I may start selling gradually instead of buying.

3) How diversified is the fund

The key question that I am concerned is if we are compensated for taking on “concentration risk”. Concentration risk is like putting all the eggs in one basket, win big or lose big.

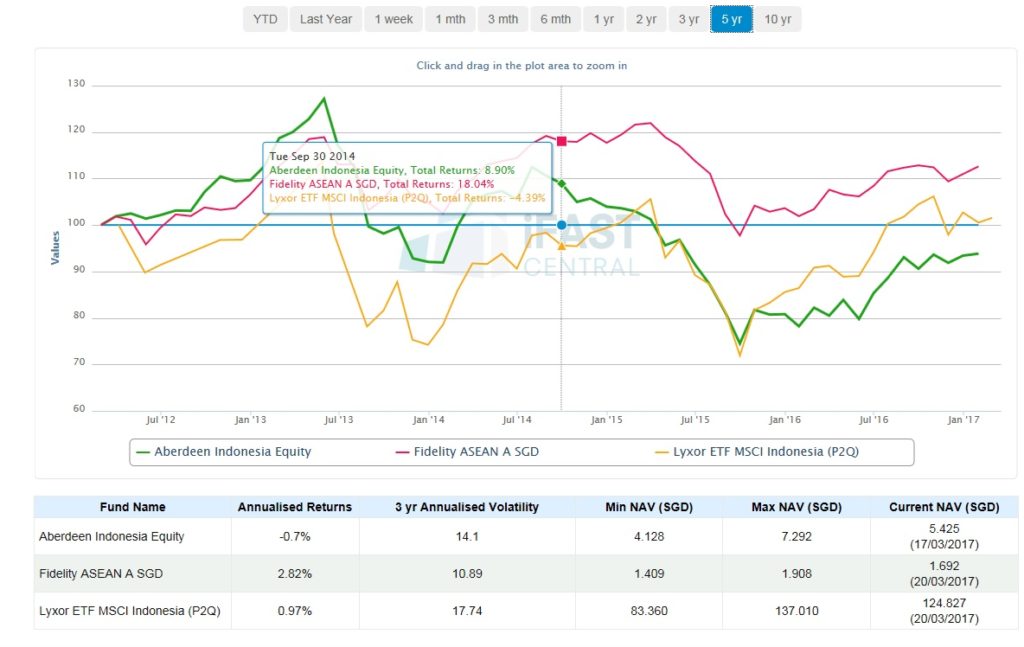

Assuming now that we want to invest into Indonesia because of a newly elected president. Maybe the economic reforms implemented will bring more stability to the country and the future outlook of corporations there look brighter. We can invest through an Indonesian fund, an Indonesian ETF or an ASEAN fund to place our investment.

What happens when we compare results in the 3 methods of investing?

In the short term, a less diversified approach may get better returns.

The Indonesian fund did 15%

The Indonesian ETF did 12%

The ASEAN fund did 8% (it invest into Indonesia, Singapore, Malaysia and Thailand)

However when we look from a 3year investment period, a diversified approach may be more favourable

For a 3y investment period:

The Indonesian fund did -0.7%pa

The Indonesian ETF did 0.97%pa

The ASEAN fund did 2.82%pa (it invest into Indonesia, Singapore, Malaysia and Thailand)

If you look closer, beyond getting better returns, being diversified (red line) offers MUCH MORE STABILITY in performance. Kind of a “Best of both worlds”!

Further tips

I avoid weird sectors to invest in such as “Agriculture” or “Climate change”. Companies in these sectors are often unstable and do not perform well long term. Good long term investments are often not fanciful but simple and evergreen ideas.