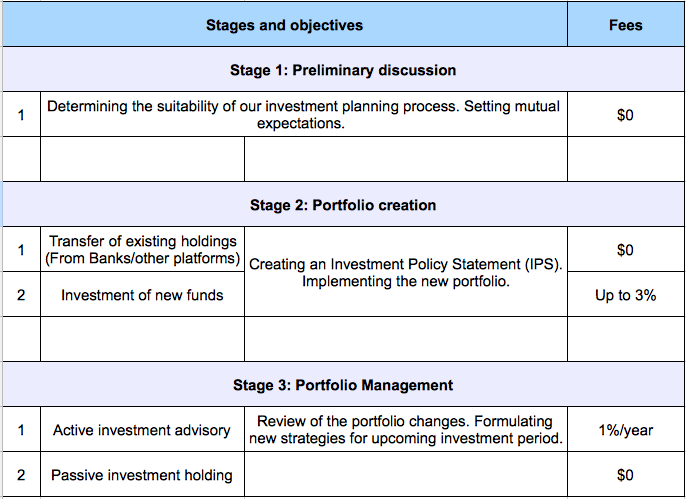

Schedule of fees

Stage 1: Preliminary Discussion

In this stage, we would collect information from you such as your investment experience, current investment assets and budget to better understand your investment objectives. We best serve a conservative or balanced risk investor. If you fit this profile, may have model portfolios to present to you to gather feedback from you.

Stage 2: Portfolio Creation

This stage takes place on a second meeting. We would present More than 2-3 portfolios for you to select. We would assist the account setup and transferring of funds into the account.

Stage 3: Portfolio Management

Along the investment period, there may be changes suggested to the portfolio. An active investment advisory would be done via a “wrap investment account” whereby fund switches are FOC. There would be a review that takes place 6-12 months after the portfolio is created.