(Updated Jan2018)

If you are looking to get a RELIABLE and HANDS FREE investment portfolio that is low risk, look no further! Purchase this automated portfolio that has discretionary management by IFAST Financial.

What is discretionary?

Discretionary means that the fund manager makes the buying and selling on your behalf – without the need for your direct intervention. Traditionally, it is offered in private banks only.

If you have been too busy to monitor your investments or are not aware of certain market opportunities with double digit returns, this works for you. It SAVES YOU TIME and dividends and capital gains can still be achieved with a system that is reliable and trusted.

Key benefits?

I’d specifically mention only the “Income Growth Portfolio” , which is the moderately conservative portfolio, as it is popular. Beyond it being hands free, some of the key benefits are as follows

- Diversification beyond what you can achieve when you invest yourself: With at least 15 funds chosen for you, you get diversification to more than 1,000 stocks and bonds!

- Access to top funds that you can’t buy as an individual: Vanguard index funds are offered only to institutional investors!

- Rebalancing among the best of funds: Funds in the portfolio are objectively measured and selected without bias.

Hence, this has translated into superior portfolio performance.

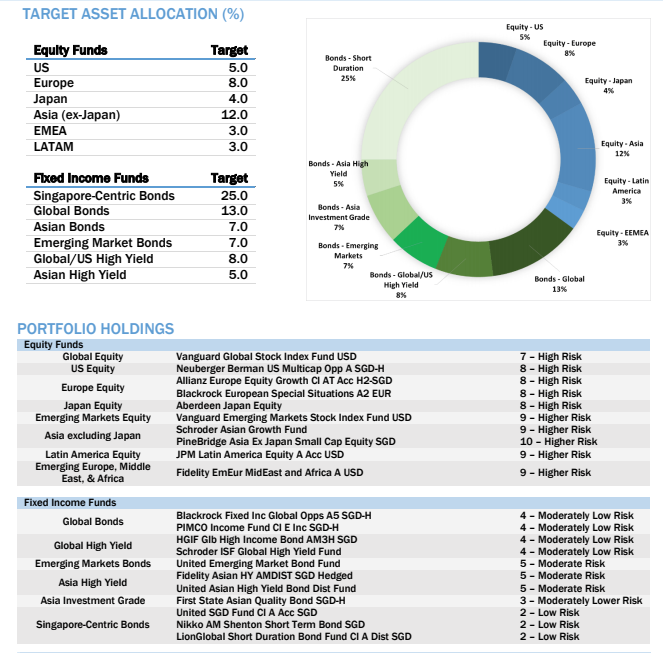

What does this portfolio really invest into?

The key benefits have been stated above. Below is a breakdown of the holdings.

With 60-70% into bonds and fixed income, the portfolio is expected to be stable. I’ll share more insights into the portfolio methodology when we meet.

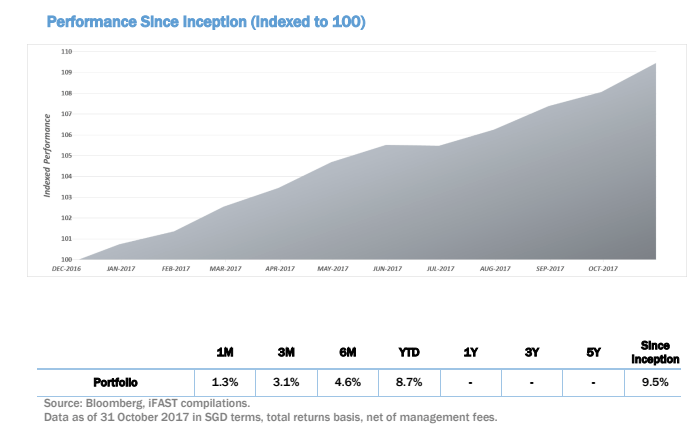

What has been performance thus far?

“Thus far” performance is NOT the way to measure what investment suits you because past performance cannot guarantee future results. Having a right methodology and system is THE way to ensure strong long term performance.

Having said that, how does 2-3% p.a in dividends + 3-4% in expected long term capital gains sound?

For this 2017, it did ALMOST 9% in total return!

I know performance has been boosted by rising share prices in general but this is still superior performance when measured against other forms of conservative portfolios.

Ready to invest? Click here to “Contact Josh Tan”.

Image credits: https://www.pexels.com & IFAST